Why Every Trades Company Needs to Get This Right

Ever feel like the harder you work, the less you’re taking home? For many Kiwi tradies running a trades company, it’s not about working more—it’s about working smarter.

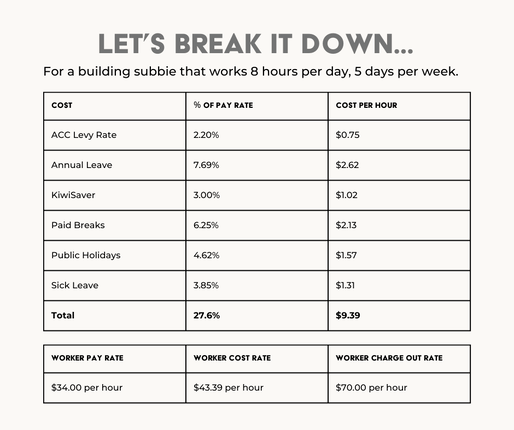

We recently shared a social media post explaining the difference between cost rate, charge rate, and pay rate, and it sparked some great conversations. It’s clear that many tradies are keen to understand how these numbers affect their business —and for good reason.

Getting your cost rate, charge rate, and pay rate sorted could be the difference between making a profit and losing money. Let’s break it down in plain English and help you make sense of your numbers, so your business stays on top.

Breaking Down Cost Rate, Charge Rate, and Pay Rate

Let’s take a closer look at what these terms really mean:

Cost Rate: The real cost of employing someone, including extras like ACC, KiwiSaver, annual leave, and sick leave.

Charge Rate: What your client pays for the job. This should cover your cost rate and include a profit margin.

Pay Rate: What you pay your staff or subcontractors—their base hourly wage.

Example: If you pay your subbie $30/hour, their cost rate could be closer to $40/hour once you factor in leave entitlements, ACC, and admin time. Your charge rate needs to cover this and still leave you with a profit.

The Hidden Costs That Can Catch You Out

Running a trades company means dealing with costs that aren’t always obvious. Missing these can quickly eat into your profits.

Some common hidden costs include:

ACC levies

KiwiSaver contributions

Public holidays and annual leave

Sick leave and downtime

Training and certifications (like upskilling in safety standards or keeping licenses current)

Keeping tools and gear in good nick—or replacing them when they’ve worn out

Admin time for quoting, invoicing, and chasing payments

How to Get Your Rates Right

Sorting your rates doesn’t have to be complicated. Here’s how to keep it simple:

Calculate Your Cost Rate

Start with the pay rate and add all the extras—KiwiSaver, ACC, leave, and tools.Set Your Charge Rate

Include your cost rate, overheads (like vehicles and insurance), and a profit margin of at least 20%.Review Regularly

Costs change, so make time to review and adjust your rates at least once a year.

Avoid These Common Mistakes

Even experienced tradies can get caught out by:

Forgetting to factor in downtime (e.g., quoting and travel).

Using the same rates year after year without reviews.

Guessing instead of calculating based on real numbers.

We Can Help You Get It Right

Running a trades company is challenging enough without having to stress over numbers.

At Shadow Administration, we help Kiwi tradies take control of their rates and simplify their admin, so they can spend less time on paperwork and more time on the tools.

Let’s chat about how we can take the hassle out of managing your rates and admin, so you can focus on what you do best.

Let's chat: 027 638 2594